Getting to grips with Sales and Operational Planning

If ERP is all about managing and controlling resources, Sales and Operations Planning is the brains behind the process and can be the difference between profit and loss.

Andrew Kinder, Solutions Director at Infor told me, “As Europe moves out of recession, many business leaders are reflecting on the lessons they have learnt. Thankfully the phrase: ‘if only we had known how the credit crunch was going to hit us’ has been joined by ‘what can we do to make sure this never happens again?’. Businesses are now examining the systems and processes that offer not just growth but protection and resilience.”

At the top of this list of options is S&OP. In a recent Supply Chain Management survey for Infor conducted by AMR Research, 88% of respondents said they are already using or planning to deploy an S&OP solution in the next 12 months. The report also found that the number one area of S&OP businesses want more support in, is in its ability to provide “what-if” simulation capability—such simulation is a critical tool in dealing with the volatility present in today’s businesses. But has S&OP changed with the times and is it applicable in today’s global agile world? Does it apply to both large and small organisations? These and a number of other questions are key to success in today’s collaborative world.

So what is it?

S&OP is a business planning process that aligns the traditional demand/supply view of the world, with the financial and business goals of the organization. S&OP is a response to the accusation that the operational plan and the business plan are often seriously mis-aligned.

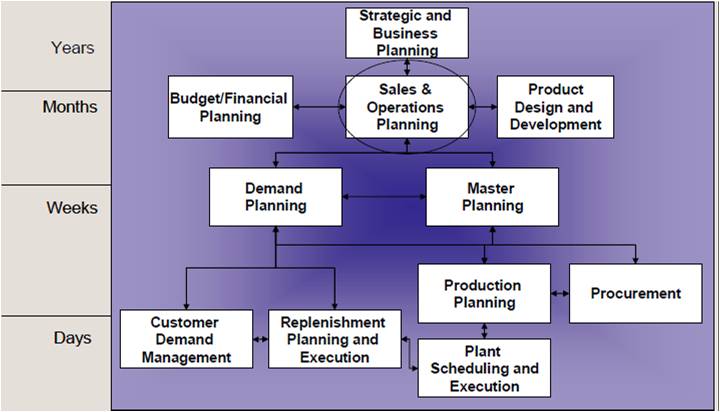

Supporting this cross-functional business process is information. And that means integrating a number of different pieces of planning data around sales, production, inventory, finance and HR to provide the executive with focus, alignment and synchronisation about the company. Plan frequency and planning horizon depend on the specifics of the industry. A properly implemented S&OP process routinely reviews customer demand and supply resources and “re-plans” quantitatively across an agreed rolling horizon. The re-planning process focuses on changes from the previously agreed sales and operations plan.

Figure 1: Putting S&OP into Context (Source: Hitachi Consulting[1])

As John Dougherty[2] said, “Its ultimate goal is to always keep the detailed sales, manufacturing, purchasing and capacity planning systems in synchronization with the latest high level plans of management (the business plan).” Or you might prefer Chuck Poirier’s view[3], “it’s about balancing supply and demand in a way that overcomes the deficiencies of weak forecasting and results in more optimum performance—from the initial suppliers to the satisfied customers.” Kinder explained that there are many different definitions that have evolved over time. At Infor, they defined S&OP for the purposes of driving their new product design as “enabling decision makers to achieve consensus on a single operating plan that profitably matches supply and demand.”

The Association for Operations Management (APICS) defines S&OP as the “function of setting the overall level of manufacturing output (production plan) and other activities to best satisfy the current planned levels of sales (sales plan and/or forecasts), while meeting general business objectives of profitability, productivity, competitive customer lead times, etc., as expressed in the overall business plan. One of its primary purposes is to establish production rates that will achieve management’s objective of maintaining, raising, or lowering inventories or backlogs, while usually attempting to keep the workforce relatively stable. It must extend through a planning horizon sufficient to plan the labor, equipment, facilities, material, and finances required to accomplish the production plan. As this plan affects many company functions, it is normally prepared with information from marketing, manufacturing, engineering, finance, materials, etc.”

What is involved?

The S&OP process brings together many areas of the business to determine anticipated demand volume and how the company plans to supply product to meet that demand and best serve the customer within the financial goals of the company. The S&OP processes is characterized by:

- A top-down and bottoms up approach, linking the company’s business plan with the current demand and supply plans

- A cross-functional, collaborative process that focuses on improving business performance

- A structured, formal set of consensus business processes based on a set time period, usually a month

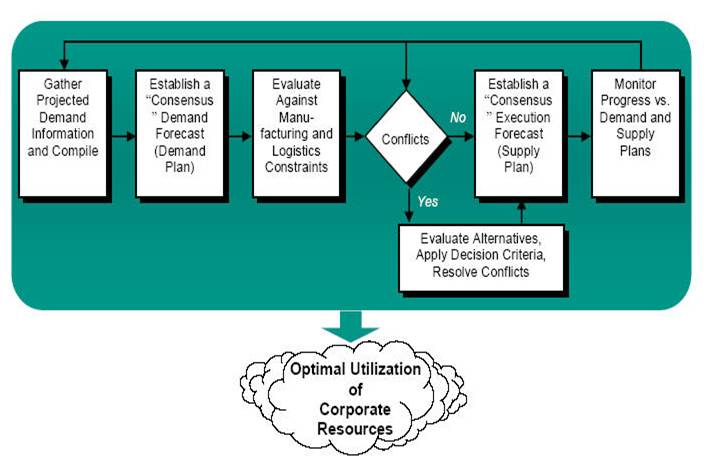

Figure 2: The Sales and Operational Planning Process (Source: Chuck Poirier, CSC)

The process starts with gathering the projected demand information and compiling it in a common format. From this information, a demand forecast is generated, typically beginning with the sales forecast originally used for planning purposes, but augmented with inputs from key customers and amended by knowledge of current operating and market conditions. The next step is to match the demand forecast against any known or anticipated manufacturing and logistics constraints. Any issues identified are then resolved; this often includes looking at alternative strategies. The final step is to monitor progress versus the altered demand and supply plans.

So what we have is different functions or business processes operating with different buckets of information granularity. Information flows both bottom up (sales, customer, VMI and co-managed programs, POS data, supply chain capacities) and top down (budget, business plan, category or customer plans, market share objectives, NPI plans). It is the reconciliation of these information flows to provide actionable planning that is the key to successful S&OP. The planning component and iterative feedback loops require common business language.

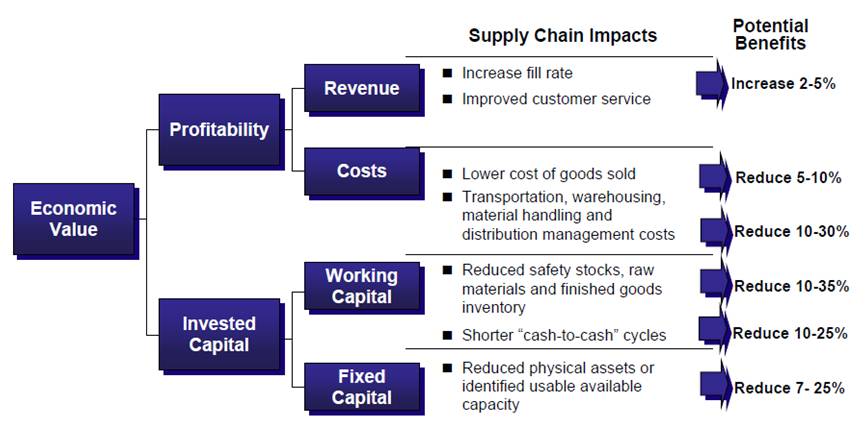

Figure 3: Sales and Operations Planning Benefits (Source: Hitachi Consulting0

So what had changed?

Hitachi Consulting [4] sees the following as the key changes that have occurred that affect S&OP:

- Globalization: Diverse and distant supply base for components and finished goods assembly increases complexity and supply lead times. There is a need for accurate, longer forecasting horizons and reduced near term flexibility.

- Contract Manufacturing (CM): While the approaches can vary from full turn key to consignment CM, the common requirement is cross organizational communication for lead time and supply commitment. This means there is a need for better planning to collaborate with CMs and longer forecast (5–9 months) horizons.

- Technology and Market Evolution: Changing consumer tastes and evolving technology mean there is a need for integrated, holistic decision-making to plan, adjust, and adapt while maintaining profitable operations.

- S&OP Supporting Technologies: Workflows can now model both decision making and optimization processes while integrating with disparate functional systems, breaking the demand planning, supply planning, BI technology silos. Therefore there is a requirement for the ability to reduce organizational effort and time needed to develop robust S&OP processes.

- Customer and Channel Focus: Conflict among direct, indirect and key customer channels means there is a need for coordinated channel and profitability management.

- Mergers: 43% of companies note M&A activity has resulted in need to connect merged operations and manage business plan impacts. S&OP therefore needs to support established, robust planning to assist in assimilation.

- Changing Operating Constraints and Costs: new product introductions, changing supply base, new customers, and fluctuating supply chain costs, all mean that there is a need for adaptive S&OP processes.

- Trial and Error: 15+ years of siloed S&OP attempts, Demand Planning and APS implementations, and ERP initiatives have led to “silo optimized” plans or led to domination by one functional group. Enterprise data is more available but not intelligently used for planning. So there is an increased desire for decision making transparency and cohesive planning.

What is happening next?

What we have is an evolution of what we expect from S&OP. Initially it was simply matching demand and supply; balancing supply with the best expectation of demand. This is the coordination of an inventory, production and procurement plan to meet demand, balancing supply with demand at the stock keeping unit (SKU) level. This remains an essential component of any planning process, but lacks a financial view of the plan. Does the plan meet with the financial goals of the business in terms of matching forecast to sales revenue expectations? Is the supply plan affordable in a way that delivers the expected margins of the business?

The next evolution was to allow the user to manipulate both demand and supply. It also included the ability to incorporate events such as new product introduction and product changes. This evolution is sometimes called scenario management. Kinder sees that this is where most organisations are, or strive to be, in their S&OP maturity curve. Planning is more strategic—12–24 months out—and operational plans are expressed in financial terms: revenue, costs and margins.

The latest evolution is to make the planning process even more agile and flexible as well as robust. Kinder explained that practitioners at this level sometimes prefer to use the term “Integrated Business Planning”—elevating the process to a higher level than “sales and operations”. The goal is an executive planning process that seeks to define the total strategic plan for the business and completely align strategy with execution. Kinder gave this example, “For example, a business may incorporate product portfolio planning into their S&OP processes, scrutinising when products are retired and when new ones are brought on-stream. Other considerations will include pricing options, channels to market, expansion and consolidation plans, mergers and acquisitions, and network design changes.”

Who is involved?

As S&OP is a major part of a manufacturing planning process, then, as you would expect, all the major ERP packages would provide modules in their ERP solution that support S&OP. Yet, this is not always the case and an Aberdeen survey revealed 85% of organizations resorting to spreadsheets to support their S&OP processes. However, the usual players such as SAP, Oracle, Sage, Infor, Microsoft Dynamics, Epicor, IFS claim to provide solutions.

The specialist supply chain management solutions such as I2 Technologies, ICON-SCM, Kinaxis, Logility and TXT e-solutions, similarly provide support but their solutions are very supply chain focused, as one would expect, and don’t support the complete picture that many organisations now need.

IBM position Cognos as a solution for S&OP. Cognos is well-known and well-used business intelligence product and therefore to use for S&OP one would need to configure the product to do the job. However IBM provide for their customers—free of charge—a set of frameworks called the IBM Cognos Performance Blueprints which provide a set of preconfigured solutions. However, the BI family of products do not provide detailed demand planning or constrained supply planning that is an important aspect of simulation within the S&OP process.

There are also a number of specialist niche players such as:

- Demand Solutions S&OP is fully integrated with Demand Solutions Forecast Management and Demand Solutions Requirements Planning and imports data through the Forecast Management database. The user-defined Import/Export utility within Demand Solutions products makes it easy to interface with other business systems.

- JDA’s Executive S&OP Workbench has been developed to take account of the Integrated Business Planning concepts I have described earlier. It utilizes key-metric graphs and charts to visually present the aggregated state of your business for informed decision making.

- Steelwedge’s Sales Planning & Performance Management (SPPM) suite leverages four modules (executive, sales, operations and collaborative) and S&OP platform that incorporate best-practice S&OP collaborative technologies with business workflows and performance management capabilities that help companies take enterprise-wide top-down (and bottom-up, middle-out) control over the revenue planning process.

Conclusions

So what does such a successful implementation of S&OP actually deliver to the business? According to research from Aberdeen Group, S&OP leaders report healthier financial results in terms of customer service levels, forecast accuracy, profitability and cash-to-cash cycle times—key measures for any business.

Simon Pollard, VP Manufacturing Operations and Execution for SAP EMEA, in a recent discussion with me gave me this scenario, “Most companies do S&OP on a weekly or monthly basis. Once the plan is done the ‘Real World’ takes over, destabilising the plan. If you join plant floors to ERP you can monitor those operations up from the shop floor to business goals. However the problem now is that currently the information at the lower levels can only be picked up quarterly and only key stakeholders are involved.”

In a recently published IDC report[5], it states, “Inaccurate forecasts can make planning and allocation of resources and servicing new projects very challenging and it can make adequately servicing customers difficult if orders come in all at once. With strained economic conditions in 2009 and 2010, planning was harder as previous year’s revenues provide little indication of future sales.” IDC concludes by recommending discrete manufacturers to adopt S&OP which synchronizes the demand forecasting process with production and customer fulfilment planning.

Kinder feels that, “S&OP has become an essential business process in de-risking the supply chain. The reality is that in any operational planning process there are multiple ways to meet customer demand. But which is the best plan? Best for customers? Best for the business? S&OP—and the modern technologies that support it—deliver confidence that a business has explored the alternatives and hit upon that elusive best plan.”

So it would seem that although S&OP is such a key element in manufacturing today, it means different things to different people depending on where they are on the evolutionary road. But if you want to move to the nirvana of Integrated Business Planning, then you are looking at joining on one side the shop floor data from Manufacturing Execution Systems (MES) with data from your supply chain partners (certainly for your Tier 1’s if not your Tier 2’s) with your HR data, Capacity data and Sales data to produce a plan which may now need to be refined more often than monthly. So we are talking about integration and collaboration not only at a technical level but also at a business process level.

[1] Trends in Sales and Operations Planning, Hitachi Consulting [2] Getting Started With Sales & Operations Planning, John R. Dougherty [3] Sales and Operations Planning – A Key Element of Supply Chain Success, Chuck Poirier, CSC [4] Hitachi Consulting, AMR Research 2005 S&OP Study, Aberdeen Group 2006 Study [5] Beating complexity, achieving operational excellence, IDC Manufacturing Insight, Pierfrancesco Manenti and Megan Dahlgren, July 2010