New Rapport360 for Asset Finance Originations

The process associated with securing a commercial lease or loan, commonly referred to as asset finance originations, is getting more and more complex and therefore the need to automate has grown. Leasing capital assets is just one way companies are moving expenditures from CAPEX to OPEX budgets. Leasing is a process by which a firm can obtain the use of a certain fixed asset for which it must pay a series of contractual, periodic, tax deductible payments. Other companies opt to secure commercial loans in order to meet their operational and cash flow needs. The asset finance organisations who handle these lease or loan applications are operating in a cut-throat market and are finding they need to differentiate themselves. Yet, until recently, they were limited in their ability to perform risk assessments because of internal technology hurdles. They often support multiple back-office processing systems which could not share customer information, needed a great deal of individual customised programming, and often required expensive upgrades to maintain over time. But this situation is changing. Rapport360 from International Decision Systems is the first front-office asset finance solution Bloor has come across to provide seamless integration with multiple back-office processing systems. In doing so, decision-makers get full visibility into customer risk across system platforms so they can make better credit decisions and gain a competitive advantage.

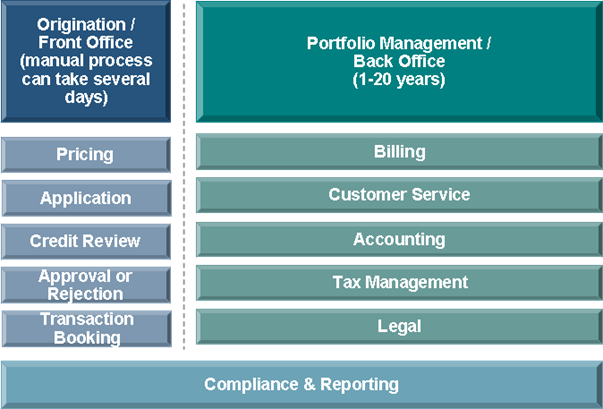

International Decision Systems (IDS) was founded in 1974 and is headquartered in Minneapolis, MN with sales offices in the UK, Australia and Singapore and a development centre in Bangalore, India. The company specialises in the asset finance software market, providing solutions which support the full lifecycle covering both front and back office operations (see Figure 1 below). For back office portfolio management, IDS provides:

- InfoLease, which provides support for leasing operations, covering functionality for loans, reporting and regulatory compliance; and

- ProFinia, which manages lease and loan portfolios along with their underlying assets and collateral.

For the front office, IDS provides:

- InfoAnalysis, which is a solution for transaction quoting including tracking of critical sales data for salespeople; and

- Rapport, which enables contract origination including credit applications, product pricing, partner relations and booking.

Figure 1: Full Asset Finance Management Lifecycle

IDS has over 250 customers in 34 countries including Wells Fargo, Bank of America, GE Capitol, John Deere, Dell, RBS Asset Finance, Olympus, Xerox, CAT, Volvo and Daimler.

Terry Welty, Chief Marketing Officer at IDS, explains “The main challenges in managing the current asset financing process are high cost, low productivity, and limited visibility of customer risk data. Often there is a large amount of re-keying which results in poor data quality and a lack of synchronisation between back-office applications. This process also slows response time and potentially results in lost sales. Perhaps one of the biggest problems, however, is that because different back-office systems do not share information, decision makers are unable to see the “big picture” of customer risk across different business units and geographic locations which can lead to difficult decision-making.”

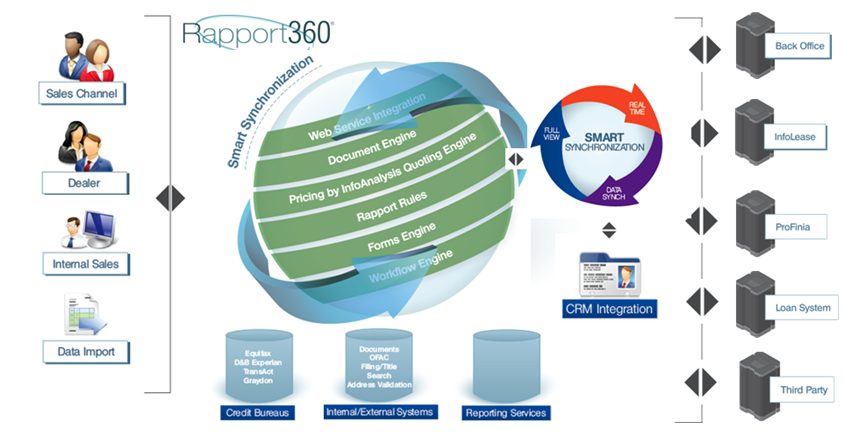

October 2010 sees the launch of a new version of the IDS Rapport solution called Rapport 360™. Rapport has always provided support for the management of workflow, screens and rules to enable organisations to provide best practices. It contains a pricing engine that supports matrix, rate card pricing, as well as asset and risk-based scenarios. Information from CRM systems, credit bureaus, and other financial and asset information resources is able to be incorporated into the system to provide a single view. Rapport supports the creation, distribution, and management of origination documents as well as bid, quote, and proposal letters.

Figure 2: Rapport 360 Coverage

So what is different about this release? Katie Emmel, Director of Product Management at IDS, told me that IDS has now added the ability to support simultaneous integration with multiple back office servicing systems through a feature called Smart Synchronization. Emmel said, “Customer records can now be updated instantly in all applicable systems. Rapport 360 provides a single, consolidated view of customer risk by capturing delinquency and exposure information.” The other key differential I identified was that administrators in user organisations are able to manage workflow, screens and rules to regulate and establish best practices across an organisation without having to use IT resources or the vendor. Rapport 360 provides support for the complete origination process from quotation through decisioning to final booking.

But what does this mean to you? The support for multiple back-office and smart synchronisation means that costs can be lowered and valuable staff resources can be refocused. Customers also gain by receiving faster response time. One of the biggest improvements, however, is that, by seeing the complete picture associated with customer exposure, finance companies can make better decisions, reduce risk and therefore improve profitability and ROA.

Bloor recommends any organisation involved in leasing to take a serious look at this new product from IDS. From what we have seen, it fills in many of the gaps that were previously missing from solutions in this marketplace.