The Dimensions of a Business Transaction

Have you ever thought about how many dimensions there are involved in a modern business transaction in any enterprise? Well I must admit I hadn’t until I was talking to Marc Borbas, Vice President, Marketing for INETCO Systems, the other day. Borbas was talking to me about his company’s business transaction monitor product, Insight, and he explained that a business transaction had three dimensions that needed to be monitored:

- The Infrastructure layer; where you are interested in the transmission path between components (ie. did the transaction make it to the next server?)

- The Application layer; where you are interested in the execution path across components (ie. did the next tier do what it was supposed to?)

- The Business layer; where you are interested in the transaction outcome and cost factors (ie. did the user achieve the right business outcome?)

Now when you think about a business transaction, you can see what Borbas is saying. We all know that a business transaction is supported by one or more applications that have to be performed in a particular sequence as determined by the underlying business process. To enable these different applications to communicate we have an infrastructure consisting of middleware. In the processing payment environment this consists of gateways, transaction middleware, backend hosts, 3rd parties, databases and all the LAN/WANs required to interconnect them. But of real importance to the business are the rules and the processes that handle what should happen.

INETCO Systems Limited were founded in 1984 with headquarters in Burnaby, British Columbia, Canada. They develop business transaction intelligence software and communications gateway products for the retail and financial payments industries. Their customer base spans 50 countries, and includes some of the world’s largest retailers, banks, telecommunication companies, and card processors such as Triton (Calypso), Fidelity, Diebold, Petro-Canada, and Nokia-Siemens. Besides Insight, INETCO offers two other products:

- POSway – A dial-up communications gateway that connects any dial-up terminal to a transaction host or switch by providing protocol conversion for TCP/IP and other dial-up protocols, multiple host support, transaction aggregation, and extensive web-based management capabilities.

- BankLink – A communications gateway software that connects TCP/IP, SNA, and other leased-line ATMs to any transaction host/switch and EFT network.

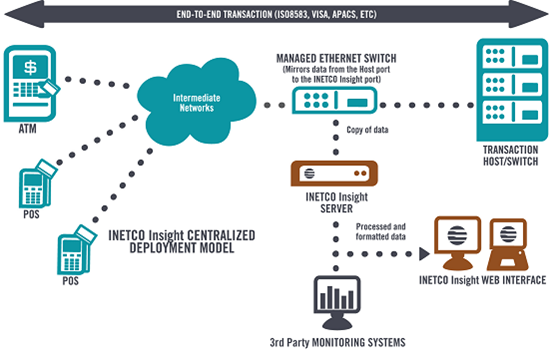

So what does INETCO Insight do? It provides out-of-the-box support for a range of financial transaction types using standard financial industry protocols such as ISO 8583 and Visa 2. It can be configured to monitor custom transaction types, including those using HTTP or XML-based protocols. Borbas explained, “It captures and decodes business transactions so you can alert on unusual events, isolate problems, and gather data to optimize transaction processing environments. The product collects data from a network mirror port, a lightweight deployment model that doesn’t modify application platforms or code.”

Figure 1: INETCO Insight deployment (Source: INETCO)

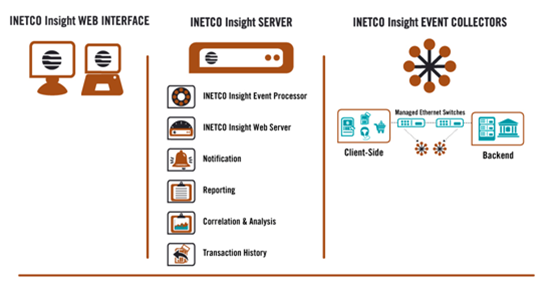

Its architecture is made up of three major components:

- Event Collectors – Monitor data activity. Those handling the volume and security requirements of network data relating to ATM and POS transactions, for instance.

- Event Processor – Decode and analyze transactions. This involves recognizing a wide variety of application message formats across packet boundaries in real-time and maintaining the relationship between the lower level network/transport aspects of a transaction and the higher level protocol and application message aspects.

- Web Server and Client – Dashboard view of network activity. Behind the normal Web 2 dashboards displays, this involves grouping application messages into complete transactions and calculating transaction based metrics such as rates, ratios, durations, and the amount of transaction concurrency.

Figure 2: INETCO Insight Architecture (Source: INETCO)

Borbas explained, “Payment IT infrastructures are complex, multi-tier environments that continue to evolve as new products and functionality are added, mergers and acquisitions tie more components together and legacy infrastructure is replaced. Unfortunately, monitoring and management practices haven’t kept pace. As a result, the business transaction information you get today is scattered, stale and difficult—even impossible—to access.” Therefore, to completely manage the whole business transaction performance you need to look not only at the performance of the applications involved, but also the performance of the infrastructure that binds the applications together and on top of that the business performance of the rules and process that drive the transaction. A tall order but one which from my view of INETCO Insight it does with aplomb.